38+ getting a mortgage when self employed

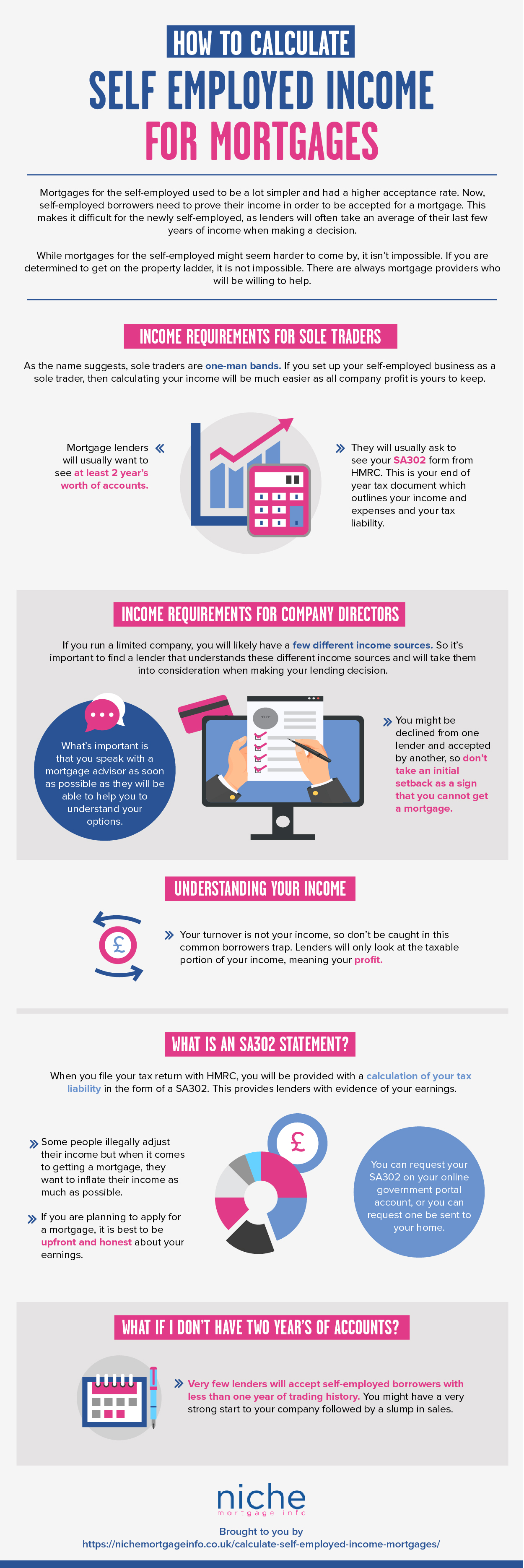

A Federal Housing Administration FHA loan is a mortgage that is insured by the Federal Housing Administration FHA and issued by an. Web Getting a mortgage when you are self-employed can be more of a challenge but its still possible.

How To Get A Mortgage When You Re Self Employed

Prior to the start of the pandemic 34 of the workforce was somehow involved in.

. Web How much income do I need to get a self-employed mortgage. But getting a mortgage when self-employed is certainly not impossible. Determine if you need a self-employed mortgage.

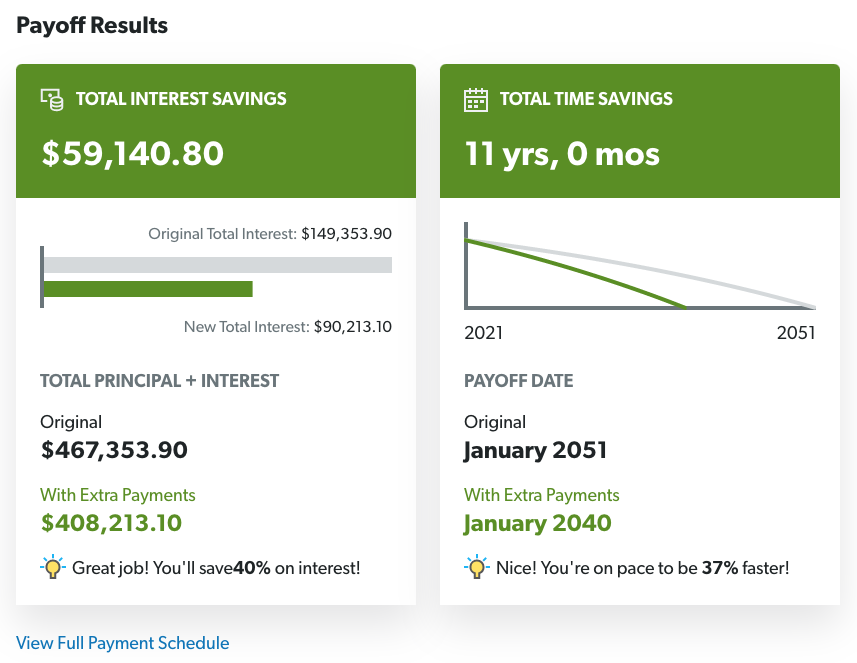

For example lets say you made a net profit of 60000 in 2020 and 75000 in 2021. Do not take on any other new debt before you apply or while your application is being considered. Web The Salt Lake City-based bank employed nearly 10000 people at year-end 2022 and operated more than 400 branches.

Web Add each years net profit. Divide the sum by 24 to find your average monthly income. Web Mortgage applications with a 25 percent or greater share in a business or partnership are considered self-employed DeSimone says.

Keep Business Expenses Separate. Because you do not have an employer to vouch for your income it can be harder to prove you have a stable income and lenders may require more evidence than if you were on a similar wage under an employer. Web One of the challenges of self-employment is getting a mortgage especially when youve been self-employed for less than two years.

Web While it is easier to get approved for a mortgage as a W-2 employee you can get approved for a mortgageyou just might need a little extra paperwork. Web If youre self-employed it can be more of a challenge to get a mortgage because youll need to prove you have a reliable income. If you are self-employed and hoping to get a mortgage then it helps to be aware.

Consider the following to increase your chance of being approved for a mortgage while self-employed. In some cases borrowers who are. Two or more years of certified accounts SA302 forms or a tax year review from HMRC.

To view or add a comment sign in. Two years of personal income tax returns Two years of. Your debt-to-income ratio or DTI is the percentage of your gross monthly income that goes toward paying your.

Resist the urge to apply. Contractor who has set up a limited company. Do Not Add More Debt.

Do self-employed people pay higher interest rates. Im now doing my 2022 taxes. Web Self-Employed Mortgage Options.

Web Im a freelance writer who hopes to be able to buy a home in the next few years and as a self-employed person I know I need to be able to show a lender a few years of solid tax returns. You might be a. Check Your Debt-To-Income Ratio.

At Landmark National Bank we recognize how popular freelance work has become in recent years. You can expect to be classified as a self-employed borrower if you own 25 or more of a single business or if you work as an independent contractor or service provider. Web If you own more than 20 to 25 of a business from which you earn your main income generally lenders will view you as being self-employed.

You would add these amounts together to get 135000. Web The good news according to Gallagher is that self-employed borrowers can usually access the same loans and lenders as home buyers working for an employer - often with a deposit as low as 5 - as long as they meet. Lenders typically want to see at least a two-year.

Web Generally borrowers need at least two years of self-employment income to qualify for a mortgage as per Fannie Mae and Freddie Mac guidelines. Web In most cases self-employed mortgage loan borrowers need to provide the following documents to prove their income to a mortgage lender. In 2022 I made just over 100k net profit.

Web Jeffrey Halbert - First Home Mortgage. There are plenty of ways to prove to a mortgage lender that you have a reliable income. There is no set amount that you have to earn to be accepted for a mortgage.

Web What you need to get a mortgage when youre self-employed. Web I never thought twice about this until I tried to get pre-qualified for a mortgage My present understanding is to qualify as self employed you need 2 consecutive years of 1099 income. Web A mortgage lender will consider you self-employed if you own more than 20 to 25 of a business from which you earn your main income.

Youll need a good credit rating a 5-10 minimum deposit and a steady taxable income that means you can make the monthly repayment comfortably. Web Tips To Put Your Best Application Forward. Despite the challenges that self-employment may pose its still possible to secure a mortgage when working for yourself.

Web Most buyers interested in getting a mortgage when self-employed do best with the same kinds of loans as other borrowers. Act now to pave the way for success. This could mean conventional mortgages not backed by government lenders.

After dividing the result by 24 your monthly income would come out to 5625. A great credit score. Web Getting a mortgage is best not left to spur of the moment especially if youre self-employed so its a good idea to get pre-qualified for your loan.

Also loan qualification is based on your taxable income. 4668 Stock price on March 13 2023. To apply for a mortgage most lenders ask for at least 2 years worth of accounts.

You either qualify or you dont based on your income Rodriguez says. Keep An Eye On Your Credit. Is there any way to count BOTH w2 and 1099 income with an FHA.

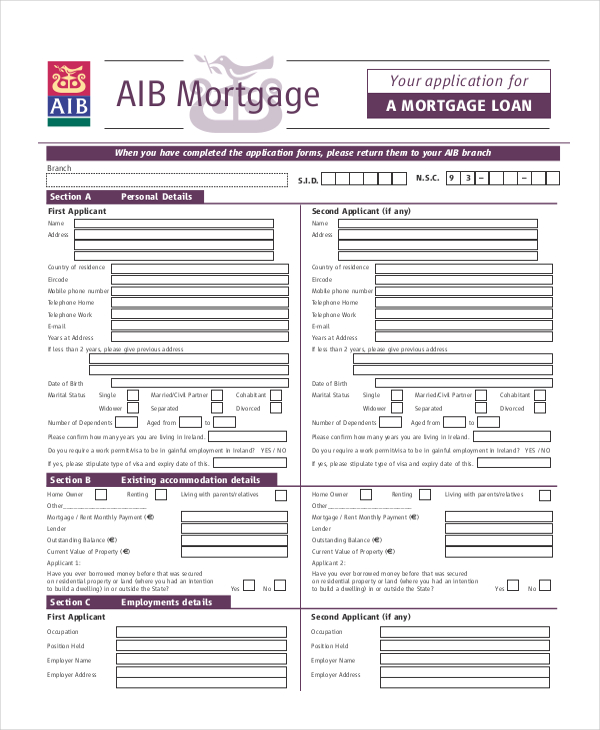

Web If youre applying for a self-employed mortgage you will need the following documents to prove your income. The good news is that lenders cannot discriminate against you based on your income type. Can I get a mortgage if Im self-employed Were here to tell you the good news.

I was unemployed for half of 2021 so we can throw that year out the window. Web Tips During the Application Process. Web 6 Likes 0 Comments - Mortgage Advice Bureau mortgageadvicebureau on Instagram.

I have the two year history but only earned income for one of those years. Closing stock price on March 8 2023. Prepare Your Down Payment.

About Mortgage Broker In Kitchener On Lynn Nequest

.png?width=500&height=357&name=DSCR%20LP%20Graphics%20(1).png)

Dscr Loans Visio Lending

How Long Until A Self Employed Person Can Get A Mortgage

Free 50 Verification Letter Samples In Google Docs Ms Word Outlook Pages Pdf

Mortgage Lenders Income Requirements For The Self Employed Niche

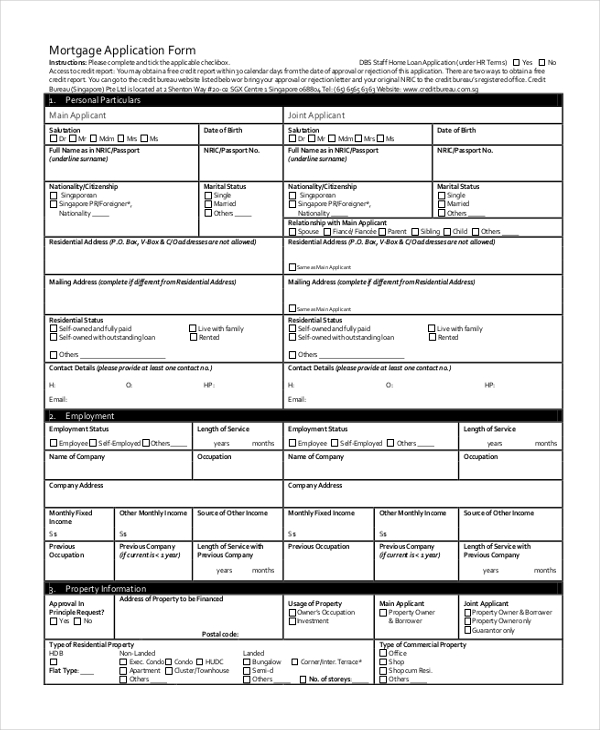

Free 10 Sample Mortgage Application Forms In Ms Word Pdf

How To Get A Mortgage When You Re Self Employed

Refinance Now To Improve Your Savings Rate Cash Flow And Overall Wealth

Self Employed Home Loan How To Get A Mortgage

Qualify For A Mortgage If You Re Self Employed Moneyunder30

Self Employed Mortgages Guide Moneysupermarket

How To Get A Mortgage When You Re Self Employed Freeagent

Self Employed Mortgage Guide

Central Coast Mortgage Broker Better Loan Rates Mortgage Choice

Getting A Mortgage When You Re Self Employed

Free 10 Sample Mortgage Application Forms In Ms Word Pdf

Self Employed Mortgages With 2 Years Accounts